$330 billion. That’s how much Hispanics spent at retail in 2014. A number of that size is a wake-up call to any retailer who has yet to weigh the impact Hispanics can have on their business. How can retailers capitalize on this expansive retail opportunity?

That’s where new research from UCI and NPD –National Panel Study-comes in. NPD is the industry’s gold standard in retail measurement and tracking; their shopping tracker captures consumer activity across all retail channels. Until now, this has only included English-dominant Hispanics. Recognizing that clients need insights based on a truly representative Hispanic panel, we developed a proprietary study with NPD that includes the full spectrum of language usage; adding Spanish-dominant and Bilingual respondents to their sample.

To take a deeper dive into what the new work reveals, I partnered with NPD’s chief industry analyst, Marshal Cohen, to discuss the findings on our latest webinar, “Rocking Holiday Shopping with U.S. Hispanics – New Research from NPD and UCI”. Here’s what we discovered:

Holidays – more people, more gifts, more shopping

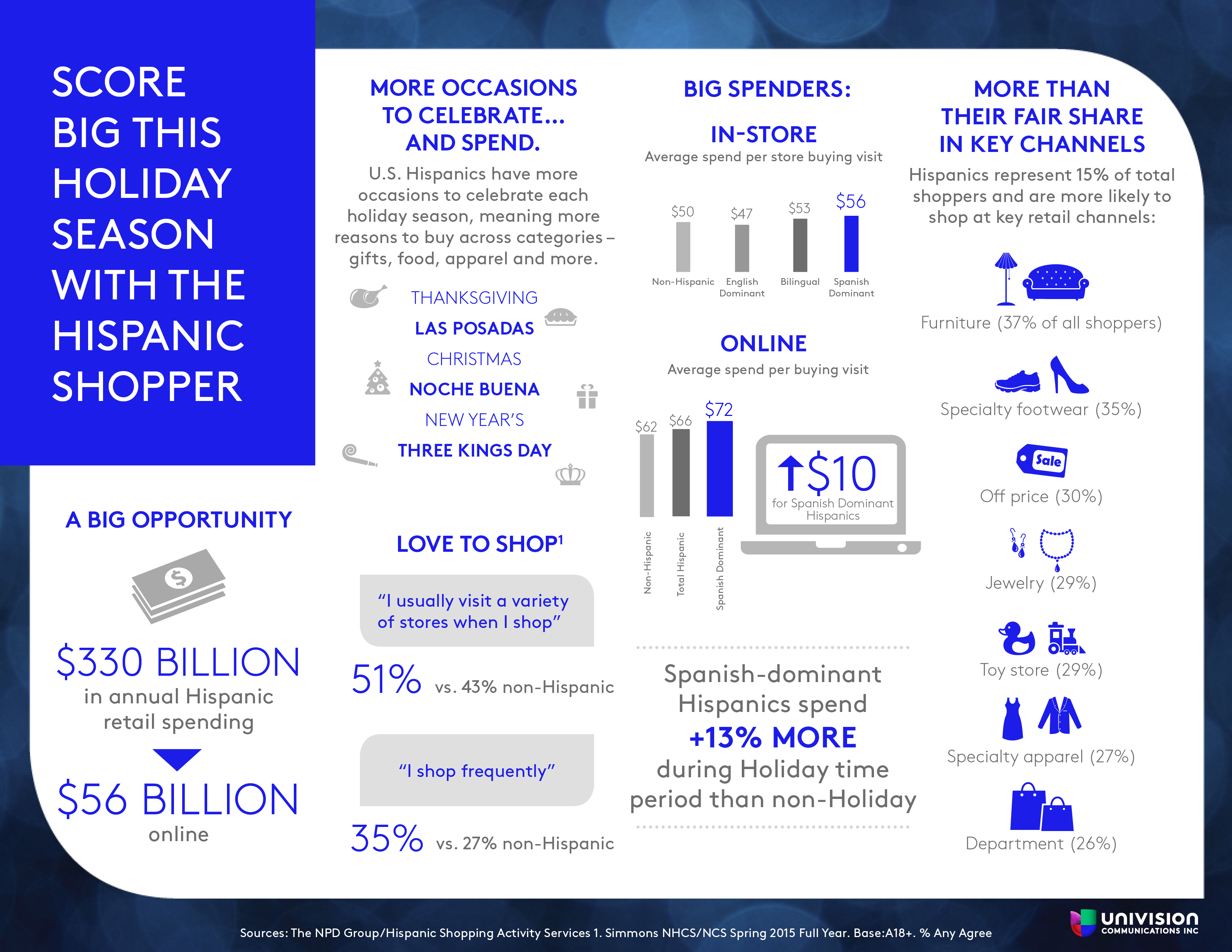

We know that the holiday season can make or break a retailer’s year. And with Hispanics, the opportunity not only lies in larger families and bigger households, they also have more occasions to celebrate. In fact, they have 3 additional celebrations that represent potential additional trips to stores (Las Posadas, Noche Buena and 3 Kings Day). This is reflected in their spending; when you compare their numbers for holiday vs. the rest of the year, spending among Spanish-dominant Hispanics grew 13%, twice that of non-Hispanics. This is one more example of how Spanish-dominant Hispanics represent a higher spend opportunity.

Hispanic hands-on shopping experience can yield a higher spend

One of the nuances of the Hispanic retail opportunity is the difference in shopping behavior. For Hispanics, shopping is a form of entertainment; they go frequently and do it in groups. We see this when we look at their share of in-store conversion (when a shopper makes a purchase). While Hispanics don’t convert as often as non-Hispanics (56% vs. 71%) because of their tendency to browse various retailers, when they do purchase, it’s más. When we look across language strata, bilinguals and Spanish-dominant Hispanics spend more per buying visit ($56 vs. $50 respectively) than non-Hispanics ($53).

A connected consumer leads to a connected shopper

The U.S. Hispanic is super connected and super digital. This holds true in their shopping behaviors, too. 17% ($56 billion) of all online U.S. sales are from Hispanics, over-indexing the share they represent of in-store sales (14%). When we look at how much they spend per buying visit, Spanish-dominant Hispanics spend $10 more than Non-Hispanics ($72 vs. $62.) Categories like beauty, consumer electronics and footwear are those they’re more likely seek out online vs. in-store.